What is the Ethereum Shanghai update?

The Shanghai update will implement a number of improvements to Ethereum with the main focus being the ability for those who staked their ETH to be able to withdraw both their staked coins and claimed accrued rewards. It's a final step in Ethereum's move away from PoW to PoS and will be implemented as a hard fork.

When will this be launched?

Current timescales are vague but it is expected to be around the second half of 2023, however, there are rumours this could occur as soon as March 2023. UPDATE: Now targetted for April but not before the last test due 14th March with developers planning to launch it on the Goerli testnet.The stakes are high and a careful launch is required to ensure a smooth and successful transition. There is a prerequisite release of the Sepolia upgrade to happen first too which is the supporting upgrade to the consensus layer for Shanghai. Delays in such releases are common as we know all too well with Eth merge / 2.0

What could this do to price action?

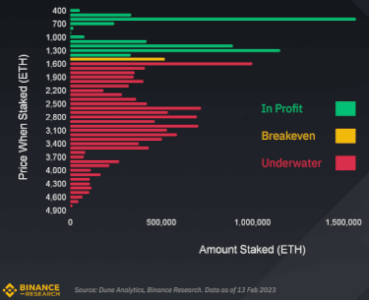

The immediate conclusion one could jump to is that as this upgrade will increase sell pressure when users can unstake their staked eth, we could expect lower prices. However, this isn't guaranteed. One factor to consider is that many stakers are NOT in profit. Staking was opened to the vast majority around the time ETH was trading near ATHs back in Dec 2020

About

All the latest guides from CryptoHogo

Article Type

Archives