Crypto Guides

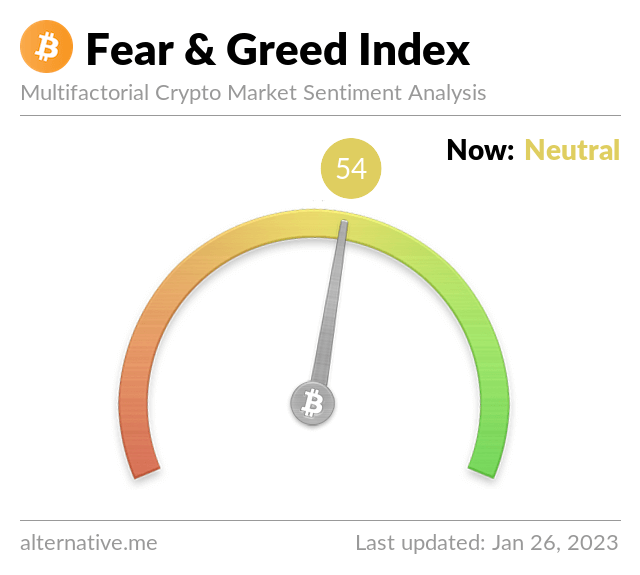

Crypto Fear and Greed Highlights

Summary of the Crypto Fear and Greed Metrics, showing the years highs and lows

Continue reading

What is the 24 hour market volume metric?

Explore the significance of 24-hour market volume in trading and investments. Understand its impact on asset prices and its role in indicating market trends and liquidity.

Continue reading

Understanding the overall crypto market cap

Understanding the crypto market cap

Continue reading

Understanding Bitcoin Dominance

Keeping a watchful eye on Bitcoin Dominance can offer valuable insights into the market's dynamics. Read our guide on what it actually means and how you can use it to make informed decisions.

Continue reading

What is a layer 2?

Layer 2 scaling solutions seem to be the talk of the town right now - and for good reason. They often provide much-needed scaling solutions and tools to their underlying chain. So what are they, how do they work etc...?

Continue reading

What is the Lightning Network?

The Lightning Network is a layer-2 scaling solution for Bitcoin that operates as a network of payment channels, enabling users to conduct instant and low-cost transactions without needing to record every transaction on the Bitcoin blockchain. It has the potential to make Bitcoin a more viable payment option for everyday use as arguably originally intended for.

Continue reading

What is the Ethereum Shanghai update?

The Shanghai update will implement a number of improvements to Ethereum with the main focus being the ability for those who staked their ETH to be able to withdraw both their staked coins and claimed accrued rewards. Learn more from our guide.

Continue reading

What is a white paper?

A white paper is a document that provides information or a proposal about a particular project or technology. It's usually longer and more detailed than a typical article and goes into great depth. A white paper isn't a document exclusive to Crypto projects. Read more on what a white paper is and why they are an important tool in researching the viability and intention of a crypto project.

Continue reading

Proof of Reserves

What is proof of reserves? A trust mechanism for CeFi that shows they hold clients' funds, but how can we trust them? Read more

Continue reading

Is Investing in Crypto actually Gambling?

Investing in Crypto markets is considered by many as gambling. Are they right? Is there any truth? Read the difference between gambling and investing and how you can determine your risk and check up on your strategy to avoid gambling in these markets.

Continue reading

Beginners guide to the Brave Browser

Read our guide on the Brave browser. A free, open-source, privacy-focused web browser built on Chromium, the technology used by Google Chrome. It blocks online adverts and trackers by default, but users can opt-in to receive relevant ads and earn Basic Attention Token (BAT) in return. The browser also has a built-in crypto wallet and a tipping feature that allows users to support their favorite content creators.

Continue reading

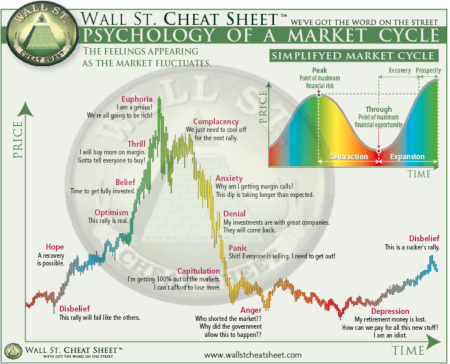

Wall Street Cheat Sheet

The Wall Street cheat sheet is a commonly referred-to chart showing the psychology and the different emotions of market cycles. The market moves in cycles, and these cycles tend to repeat themselves. This cheat sheet, although aimed at traditional markets, shows what goes through the minds of retail traders and is still an excellent reference.

Continue reading

How to receive free Crypto

Believe it or not, there are a few ways you can receive Crypto for free! From air drops to earn and learn programs, discover more in our short guide to earning free crypto

Continue reading

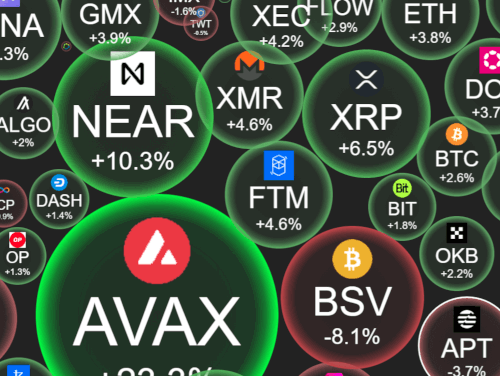

Crypto Bubbles

Crypto Bubbles is a powerful, user-friendly data visualization tool that makes it easy to stay on top of the cryptocurrency market. Whether you're a seasoned trader or just getting started. It's fun to use too!

Continue reading

Long and Short? What does it mean?

Our Jargon Guide covers lots of terms and acronyms but sometimes we need to dig a bit deeper. In this guide, we will cover "long" and "short".

"Long" or "going long" on a coin is another way of saying that you are buying the coin, and going "short" on a coin is another way of saying that you are selling the coin. But it's a bit more nuanced than that.

Airdrops in Crypto - What are they and how can you benefit?

What is an airdrop? Simply put it is when a project gives away completely free coins / tokens. Want a piece of the action? Too good to be true? Read our guide for more information.

Continue reading

Bitcoin Halving Cycles

Although Bitcoin is already over 15 years old, it is still in the early stages of its halving events, with the fourth halving occurring on April 20th 2024. The next halving is not expected to take place until 2028. While it is true that over 90% of all Bitcoin has already been mined, there are many more halving events to come.

Continue reading

Ethereum Gas Fees Explained

Ethereum gas fees are calculated based on the complexity of the transaction and the current demand on the Ethereum network. The cost of gas is measured in Gwei, and priced accordingly based on supply and demand on the network at the time of the transaction. Miners have some discretion in determining the gas price they are willing to accept for processing a transaction. Ethereum gas fees can be expensive due to high demand for computational resources on the network and the complexity of certain transactions. The switch to proof-of-stake (PoS) consensus has not yet significantly reduced gas fees on the Ethereum network.

Crypto Jargon / Lingo Explained

Cryptocurrency can be confusing, especially when it comes to the technical terms and jargon used in the industry. Words like blockchain, mining, and wallet may be unfamiliar, and they can have specific meanings in the cryptocurrency world that differ from their everyday usage. "wallet" for example in the context of cryptocurrency and the real world is somewhat different.

Continue reading

Beginners Guide To TradingView

TradingView it is a fanatic tool for clearly reading chart data for almost every asset from crypto, indices, and stocks. It is probably the single most important tool in any investors toolset. It has by far the most chart data, tools and social features of any charting platform.

It offers a completely free plan which is more than enough to get you started on your journey. A paid plan really isn’t necessary until you get deeper into trading and want to take advantage of the enhanced features offered.

Understanding the Crypto Fear and Greed Index

The Crypto Fear and Greed Index is a useful tool for understanding the sentiment of the cryptocurrency market. Understand how this indicator can be used in conjunction with other market analysis techniques to help you make more informed decisions about when to buy and sell your position.

Continue reading

About

All the latest guides from CryptoHogo

Article Type

Archives